They expect revenues for the quarter of $330.9 million.

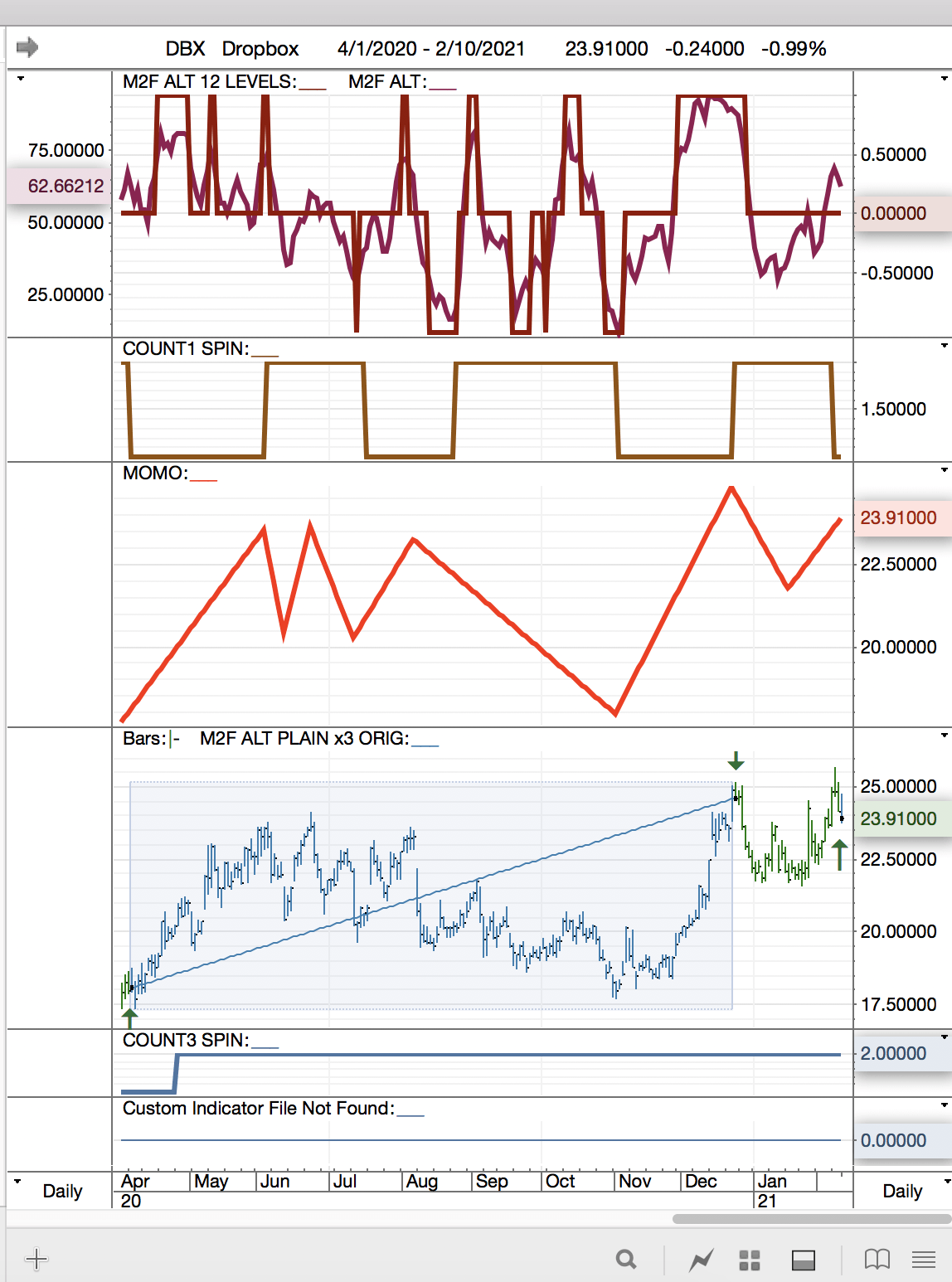

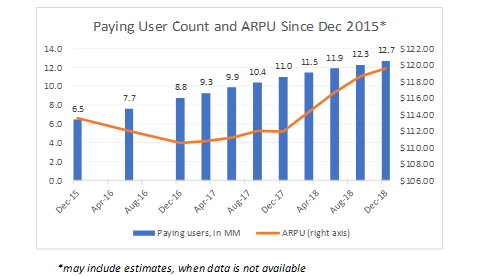

Here’s what you should expect: Analysts Expect Lower Profits, More RevenueĪnalysts estimate Q2 earnings will come in at seven cents per share. The San Francisco-based cloud storage company may beat estimates, however, competitive threats could overshadow the company’s profits and double-digit growth. The work from home trend is only accelerating and in the next few quarters, the company’s sales will grow as a result.ĭisclosure: On the date of publication, Chris Lau did not have (either directly or indirectly) any positions in the securities mentioned in this article.Dropbox (NASDAQ: DBX) reports earnings after the bell, marking its first full quarter as a publically traded company since DBX stock launched its initial public offering (IPO) on March 23. Your Takeawayĭropbox is an attractive, out of favor technology stock. As profits expand, the multiple will decline. In the table above, Dropbox scores lower than the index on value, due to the price-to-earnings ratio. As long as that metric grows, Dropbox, whose shares trade at unfavorable valuations, will have upside. Investors need to look carefully at the company’s future average revenue per user (“ARPU” or “ARR”). So long as one of the sharers has a Dropbox account, the recipient may get documents electronically. “And we are constantly toggling between tools, whether it’s our Slack or Zoom or Atlassian or Dropbox, constantly bouncing around between tools.”įrom a practical sense, Dropbox is a “go between” for sharing content among companies and clients who are on a different platform. “We don’t know where to find our various documents and whether it’s a cloud doc or a Microsoft doc or Adobe, Google, content is everywhere,” he said. Tim Regan did not look at the other offerings as competition. As 450,000 of its business teams use the new Dropbox, they will figure out efficient ways to suit the work-from-home space. Dropbox added it last year and saw engagement rise by 100,000 users sequentially. MetricsĪs previously mentioned, Smart workspace is a new feature. Otherwise, a 4.5% perpetuity growth rate and the metrics shown below will value Dropbox stock at around $24.00. Readers may click on the finbox link to change the estimates and to come up with another fair value. In this 5-Year Discounted Cash Flow Growth model, consider this revenue trajectory: (USD in millions) Investors may assume revenue growth increasing over the next five years. So, as customers try out the service and experiment with the “smart workspace” feature, user engagement will continue climbing. Usage is up 25% relative to pre-Covid levels. At the Citi Global Technology Conference, Chief Accounting Officer Tim Regain highlighted the opportunities that HelloSign offers.įor example, it has the chance to accelerate the uptake of HelloSign.

0 kommentar(er)

0 kommentar(er)